Monoova Payments Plugin in WooCommerce: Speed, Security & Growth

The Monoova Payments Plugin brings secure, modern payments to WooCommerce stores in Australia. With support for cards, Apple Pay, Google Pay, PayID, and PayTo, it simplifies checkout, reduces costs, and ensures faster, more reliable transactions. Designed for merchants of all sizes, the plugin unifies payment options into one system, helping businesses grow with confidence.

Introduction: Unifying Payments in Australian E-commerce with Monoova

The contemporary Australian e-commerce landscape presents a significant challenge for merchants: a fragmented and increasingly complex payments ecosystem. Businesses often find themselves navigating a patchwork of multiple providers, gateways, and technologies to accept various forms of payment, leading to operational inefficiencies, higher costs, and a disjointed customer experience. This complexity is a direct barrier to growth, consuming valuable resources that could be better spent on product development and customer acquisition.

Monoova consolidates disparate rails into a single API layer. As a leading Australian payment automation platform, Monoova’s core mission is to unify and streamline all payment processes within a single, cohesive infrastructure. The platform is engineered to manage the full spectrum of payment rails, from traditional methods to the latest real-time innovations. This includes not only standard credit and debit card processing and digital wallets like Apple Pay and Google Pay, but also a comprehensive suite of account-to-account (A2A) payment types such as BPAY, Direct Debit, and, most critically, real-time transactions powered by the New Payments Platform (NPP) through PayID and PayTo.

However, Monoova's capabilities extend beyond simple payment acceptance. The platform is designed as a comprehensive financial operations (FinOps) engine, offering value-added services like automated reconciliation, ledgering, and foreign exchange (FX) services. This broader scope addresses the entire lifecycle of a business's funds, from receiving customer payments to managing cash flow and paying suppliers. The Monoova Payments Plugin for WooCommerce serves as the critical bridge, bringing this powerful, unified financial infrastructure directly into the world's most popular e-commerce platform. This report provides a detailed technical analysis of the plugin, deconstructing its architecture, payment flows, and the strategic advantages it delivers to merchants.

The E-commerce Engine: Understanding the WooCommerce Ecosystem

WooCommerce stands as the dominant force in the global e-commerce market. As a free, open-source plugin for WordPress, it powers millions of online stores, from nascent startups to large-scale enterprises, representing a significant portion of all e-commerce sites on the internet. Its popularity stems from its unparalleled flexibility, customization capabilities, and the principle of full data ownership, which gives merchants complete control over their content and operations—a key differentiator from hosted solutions.

This flexibility is enabled by a vast ecosystem of third-party plugins and extensions that allow merchants to add virtually any functionality imaginable. Among these, payment gateway plugins are arguably the most critical component. They function as the digital equivalent of a physical store's checkout stand, processing the financial transactions that are the lifeblood of the business. The choice of a payment gateway has a direct and profound impact on a store's success. Industry data reveals that nearly 70% of online shopping carts are abandoned before purchase, with payment-related friction being a primary contributing factor. A slow, confusing, or untrustworthy checkout process can instantly erode customer confidence and lead to lost sales.

The open-source nature of WooCommerce, while a strength, also creates a "responsibility gap." Unlike fully managed platforms, merchants are ultimately responsible for their store's hosting, security, performance, and the quality of their chosen integrations. This places a significant burden on the business owner, particularly in the high-stakes domain of payments, which demands stringent security (PCI compliance), high reliability, and a seamless user experience. A poorly coded or maintained payment plugin can introduce security vulnerabilities, fail during peak sales periods, or offer a clunky interface, all of which directly damage revenue and reputation. The Monoova Payments Plugin is engineered to fill this gap, providing a foundational component that brings the security, reliability, and performance of an enterprise-grade financial platform to the flexible world of WooCommerce.

The Solution: Introducing the Monoova Payments Plugin for WooCommerce

The Monoova Payments Plugin for WooCommerce is a sophisticated software solution designed to seamlessly integrate Monoova's advanced payment infrastructure directly into the WooCommerce checkout process. Its primary purpose is to deliver a superior payment experience for both the merchant and the end customer by offering a comprehensive suite of modern payment options backed by a robust and secure technical architecture.

The plugin's core features are designed to address the key pain points of modern e-commerce:

Diverse Payment Methods: It provides customers with a full spectrum of payment choices, including all major credit and debit cards, express digital wallets (Apple Pay and Google Pay), and cutting-edge Australian Account-to-Account (A2A) options like real-time payments via PayID and digital payment agreements through PayTo.

Integrated Management: A user-friendly dashboard is embedded directly within the WordPress Admin interface. This allows merchants to track transaction history, monitor payment statuses, and process refunds without needing to log into a separate, external portal, thereby streamlining daily operations.

Modern, Future-Proof Architecture: The plugin is built upon Monoova’s powerful and secure REST APIs and is designed for the future of WooCommerce. A key technical differentiator is its native integration with WooCommerce Blocks. This signals a commitment to the platform's modern, block-based architecture (also known as Gutenberg), ensuring greater stability, performance, and easier customization for merchants using up-to-date themes. This contrasts sharply with legacy plugins that may rely on outdated shortcodes, which can lead to compatibility issues and a less flexible user experience.

By focusing on a modern technical foundation, the Monoova plugin provides merchants with the confidence that their payment system is not only powerful today but also prepared for the future evolution of the WooCommerce platform.

A Look Under the Hood: Deconstructing the Payment Flows

The plugin's sophistication is best understood by examining the architecture of its core payment flows. Each flow is meticulously designed to optimize for security, reliability, and user experience, leveraging specific technologies to solve common e-commerce challenges. The following analysis is based on the plugin's architectural diagrams.

Card Payments: Secure, Fast, and Flexible

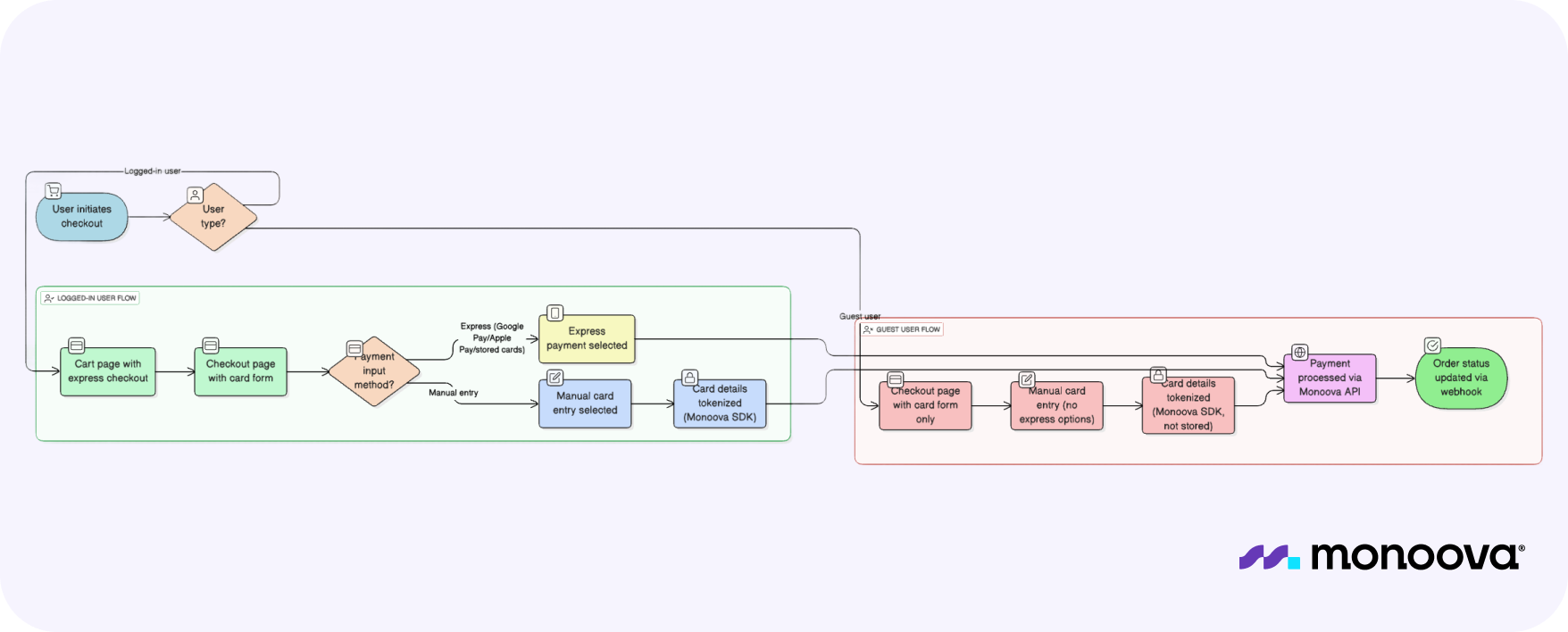

The card payment flow, illustrated in the above diagram, is engineered for maximum security and user convenience. The process intelligently differentiates between new and returning customers to reduce friction.

User Identification: The flow begins by checking if the user is logged in or proceeding as a guest.

Checkout Experience:

Logged-in Users are presented with a streamlined experience. They can choose from express options like Google Pay or Apple Pay, or select a previously saved card for a one-click payment.

Guest Users are shown a standard, secure form for manual card entry.

Client-Side Tokenization: This is the most critical security step in the flow. For both logged-in and guest users, card details are captured and tokenized using the Monoova SDK directly within the customer's browser. This process converts sensitive card information (the Primary Account Number, or PAN) into a non-sensitive, unique string of characters called a token. This architecture ensures that raw, sensitive card data never touches or passes through the merchant's server. This dramatically reduces the merchant's PCI DSS (Payment Card Industry Data Security Standard) compliance burden, as they are no longer handling sensitive cardholder data.

Payment Processing: The secure token is sent from the user's browser to the merchant's server. The server then uses this token to make a secure API call to the Monoova Cards API to authorize and process the payment.

Asynchronous Confirmation: Once Monoova processes the transaction, the order status in WooCommerce is updated via a webhook. This is an automated, server-to-server communication that pushes the final transaction status (e.g., success or failure) to the merchant's store. This event-driven approach is highly reliable, ensuring that the order is updated correctly even if the user closes their browser or experiences a network interruption after payment submission.

PayID: Instant Account-to-Account Transactions

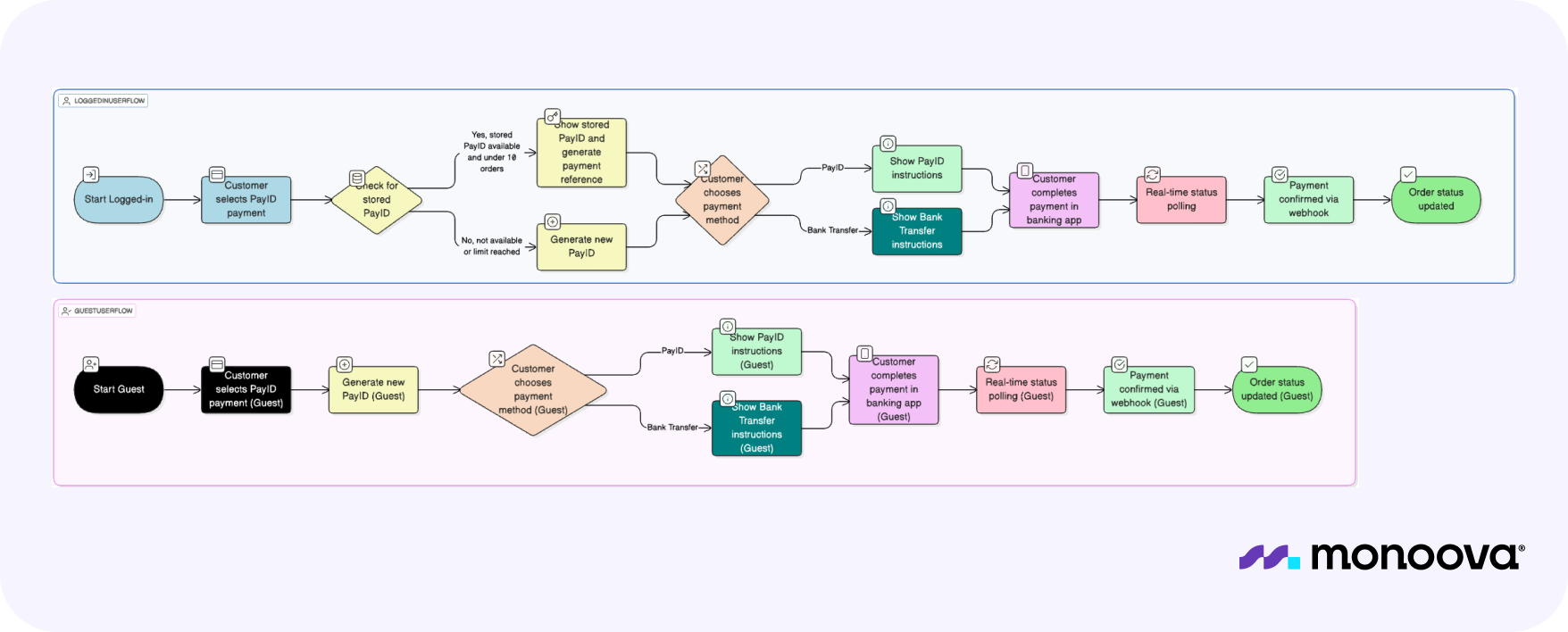

The PayID flow, detailed in this diagram, addresses the unique challenges of an asynchronous, bank-initiated payment method with a sophisticated dual-mechanism approach.

Initiation: The customer selects PayID at checkout. The plugin communicates with Monoova's API to generate a unique PayID and payment reference specific to that order.

Customer Action: The user is instructed to complete the payment from within their own mobile banking application using the provided details. At this point, the transaction moves outside the direct control of the WooCommerce site.

Confirmation and User Feedback: The plugin solves the "waiting" problem with a two-pronged strategy:

Real-time Status Polling: The checkout page actively polls Monoova's API at set intervals, checking for a status update. This provides immediate feedback to the user on the screen, for instance, by displaying a "Waiting for payment..." message that can change to "Payment received" without requiring a page reload.

Webhook Confirmation: Simultaneously, Monoova's system listens for the incoming payment on the New Payments Platform (NPP). The instant the funds are received, Monoova sends a definitive webhook to the WooCommerce store. This webhook serves as the authoritative trigger to finalize the order, update its status to "Processing," and initiate fulfillment.

This dual architecture provides an optimal experience: the user receives immediate, reassuring feedback on the checkout page, while the merchant benefits from a guaranteed, reliable backend confirmation that is not dependent on the user's browser session.

PayTo: The Future of Digital Agreements

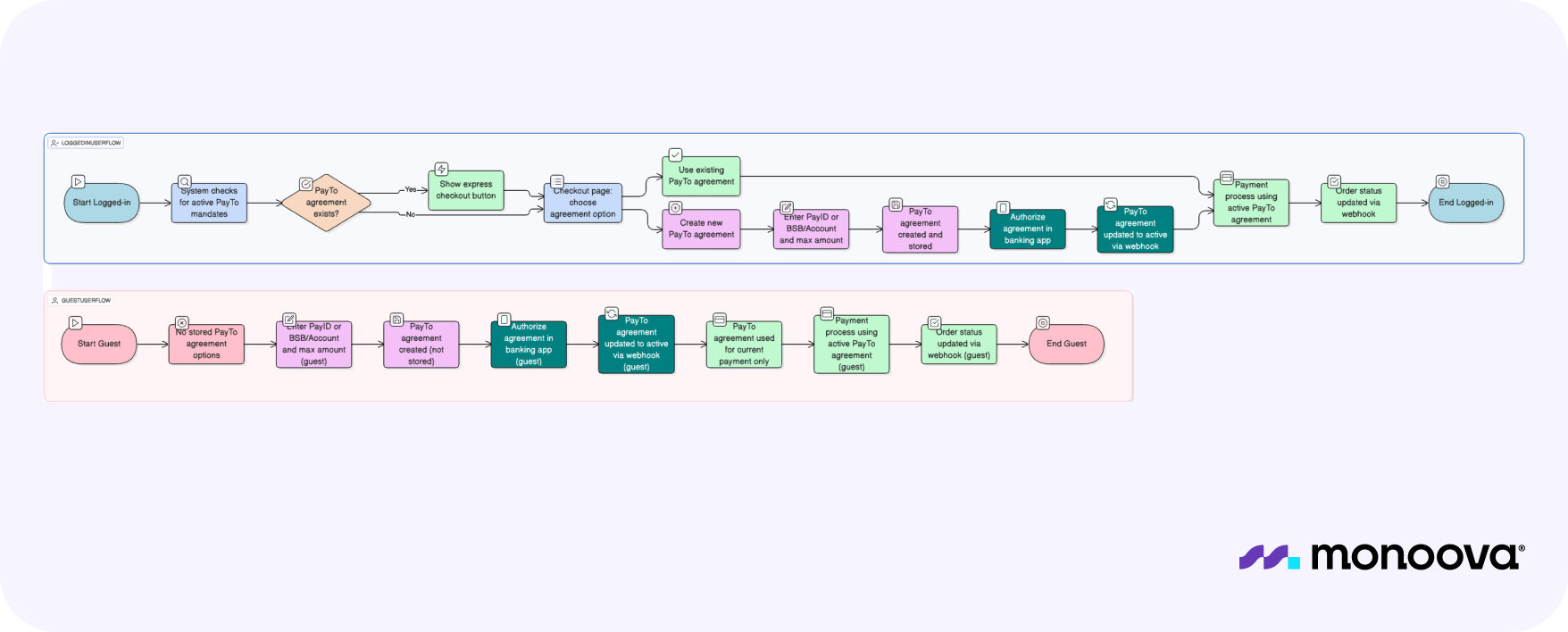

PayTo is the only NPP-native mandate system currently supported in WooCommerce. It moves beyond single transactions to establish durable, recurring payment arrangements, fundamentally changing how businesses can manage ongoing revenue.

Agreement Creation: The customer selects PayTo at checkout. Rather than just paying, they are initiating the creation of a PayTo agreement (also known as a digital mandate). The plugin generates the agreement details via the Monoova PayTo API.

Customer Authorization: The customer is prompted to switch to their banking app, where they review the terms of the agreement (e.g., payment frequency, amount limits) and provide explicit authorization. This action securely links their bank account to the merchant for future payments.

Agreement Activation: Once authorized in the banking app, Monoova receives confirmation and sends a webhook to the WooCommerce store, changing the status of the PayTo agreement to "active."

Payment Initiation: With an active agreement in place, the payment for the current order is processed. More importantly, the merchant is now authorized to initiate future payments against this agreement without requiring further action from the customer. This is ideal for subscriptions, installment plans, or usage-based billing.

The architectural choice to support PayTo provides a powerful tool to combat involuntary churn. Unlike credit cards, which expire or are cancelled, bank accounts are far more stable. By tying recurring payments to a PayTo agreement, merchants can significantly reduce payment failures, leading to more predictable revenue and a higher customer lifetime value (LTV).

The Technical Architecture: How the Plugin Integrates with Monoova

The Monoova Payments Plugin functions as a sophisticated orchestration layer, built on a standard and robust technology stack, that connects the WooCommerce environment to Monoova's powerful suite of financial APIs.

The plugin's architecture is composed of two primary components:

Server-Side Logic (PHP): Written in PHP to integrate natively with WordPress and WooCommerce, this component handles all backend operations. Its responsibilities include communicating with Monoova's APIs, creating payment intents, managing order states based on transaction outcomes, and, crucially, processing incoming webhooks.

Client-Side Experience (JavaScript): This component manages the user-facing elements of the checkout process. It is responsible for rendering the payment forms, dynamically displaying payment options, and interacting directly with the Monoova SDK for secure, client-side tokenization of card details.

This architecture leverages a microservices-style interaction with Monoova's platform, calling specific REST APIs based on the required function:

Cards API: Used for processing all tokenized credit and debit card transactions.

PayTo API: Handles the entire lifecycle of PayTo agreements, from creation and authorization to initiating payments against active mandates.

Payments API: A general-purpose API used for managing other transaction types like PayID and receiving overarching payment lifecycle events.

The lynchpin of this entire integration is the extensive use of webhooks. Webhooks facilitate an event-driven architecture, which is a best practice for modern, distributed systems. Instead of the WooCommerce store constantly having to ask Monoova for status updates (which is inefficient and brittle), webhooks allow Monoova to proactively push critical information to the store the moment an event occurs (e.g., payment.succeeded, agreement.activated, payment.failed). This asynchronous communication model ensures that the two systems remain synchronized and that the merchant's order data is always accurate and reliable, decoupling the store's operational integrity from the customer's browser session.

The Strategic Advantage: Benefits and Use Cases for Merchants

The technical features and architectural decisions of the Monoova plugin translate directly into tangible, strategic benefits for merchants. By moving beyond basic payment acceptance to offer a comprehensive financial operations tool, the plugin empowers businesses to improve cash flow, reduce operational overhead, enhance security, and increase customer conversion and retention.

The following table maps the plugin's key technical features to their corresponding benefits for both the merchant and their customers:

Technical Feature | Merchant Benefit (The "Why") | Customer Experience (The "So What") |

|---|---|---|

PayID & PayTo Integration | Improved Cash Flow & Lower Costs: Instant settlement via the NPP means funds are available immediately, not after days. A2A payments typically have lower transaction fees than cards, improving profit margins. | A secure, modern, and convenient way to pay directly from a bank account without entering card details. |

PayTo Agreements | Reduced Involuntary Churn & Predictable Revenue: Drastically cuts down on payment failures from expired/cancelled cards for subscriptions, leading to higher customer LTV and more stable, predictable revenue streams. | "Set and forget" convenience for recurring bills and subscriptions. No need to update payment details when a card expires. |

Client-Side Tokenization (SDK) | Enhanced Security & Reduced PCI Scope: Significantly simplifies PCI DSS compliance by ensuring no raw card data ever transits or is stored on the merchant's server. This reduces security risk and compliance costs. | Increased trust and confidence that their financial data is being handled with the highest level of security. |

Webhook-Driven Updates | Operational Efficiency & Data Integrity: Automates order status updates, eliminating manual reconciliation and ensuring the order management system is always accurate, even if the customer closes their browser. This saves time and prevents fulfillment errors. | A smooth post-purchase experience where order confirmations and shipping are triggered reliably and quickly. |

Unified Payment Options | Increased Conversion Rates: Offering a full suite of modern and traditional payment methods caters to all customer preferences, reducing checkout friction and cart abandonment. | The freedom to pay how they want, leading to a faster, more satisfying checkout. |

Integrated Admin Dashboard | Streamlined Operations: Allows staff to manage transactions and refunds directly within the familiar WordPress environment, saving time and reducing training overhead. | Faster and more efficient customer service for refunds or payment-related inquiries. |

Use Cases

This combination of benefits makes the plugin an ideal solution for a wide range of e-commerce business models:

Subscription E-commerce (e.g., meal kits, software-as-a-service, digital memberships): These businesses can leverage PayTo to build a highly resilient recurring revenue engine. By migrating customers from credit cards to PayTo agreements, they can dramatically reduce involuntary churn and stabilize their cash flow.

High-Value Retailers (e.g., electronics, furniture, luxury goods): For businesses selling high-ticket items, the transaction fees on card payments can be substantial. Offering PayID provides a secure, low-cost alternative that can significantly improve profit margins on each sale.

Businesses with High Order Volume: Companies processing thousands of orders daily benefit immensely from the webhook-driven architecture and automated reconciliation. This reduces the immense operational burden of manually tracking payments and resolving discrepancies, freeing up staff for more value-added activities.

Any Merchant Seeking to Modernize: In a competitive market, meeting customer expectations is paramount. By adopting the Monoova plugin, any merchant can offer the latest payment methods expected by Australian consumers, improving their brand perception as a modern, trustworthy business and ultimately increasing conversion rates.

Conclusion

The Monoova Payments Plugin for WooCommerce is far more than a simple payment gateway. It is a strategically engineered solution that addresses the core challenges of modern e-commerce: payment complexity, security, operational efficiency, and customer retention. Through its sophisticated technical architecture—leveraging client-side tokenization for security, webhooks for reliability, and native support for modern WooCommerce Blocks—the plugin provides a stable and future-proof foundation for any online store.

By unifying a comprehensive suite of payment methods, from traditional cards to the instant, account-based transactions of PayID and the recurring revenue power of PayTo, the plugin equips merchants with the tools to not only increase conversion rates but also fundamentally improve their financial operations. It transforms the payment process from a simple necessity into a strategic asset. For any Australian business running on WooCommerce, the Monoova plugin represents a powerful investment in security, efficiency, and long-term growth, effectively bringing an enterprise-grade financial operations platform into the accessible and flexible world of open-source e-commerce.

Monoova Payments Pty Limited (ACN 126 015 227 | AR No. 428863) trading as Monoova (Monoova) is the authorised representative of Monoova Global Payments Pty Ltd (ACN 106 249 852 | AFSL 421414) (Monoova Global), being the issuer of the Combined Financial Services Guide & Product Disclosure Statement Non-Cash Payment Products and Services (FSG/PDS).

Copies of the FSG/PDS and the terms and conditions of the products and services offered by Monoova and Monoova Global (disclosure documents and terms) are available by contacting Monoova at support@monoova.com. You should consider the relevant disclosure documents and terms before deciding whether to acquire, or continue to hold, the product or service. The information provided on this website is factual information, is given in summary form, and does not purport to be complete. The information set out does not take into account your particular investment objectives, financial situation or needs. Before acting on any information, you should consider the appropriateness of the information having regard to these matters, and in particular, you should seek independent legal, financial and tax advice. To the extent that the communication/document contains information sourced from third parties, statements made by third parties or provides link to third party websites, Monoova takes no responsibility for the accuracy, currency, reliability and correctness of any information included in the material provided by or statements made by third parties nor for the accuracy, currency, reliability and correctness of links or references to information sources (including internet sites) operated by third parties.

Your Partner for Fintech App Development

We build secure & scalable fintech solutions

with custom integrations, seamless payments, and long-term support.